Working with Jigsaw Finance

Whether you are an independent dealer, a large dealer group, or an e-commerce concern, Jigsaw Finance Limited have a variety of technical solutions on hand to help you submit applications for vehicle finance, including:

- The Optimus point-of-sale system

- Finance calculator plugins

- White-labelled application forms

- Direct integration via our API

- Proprietary CRM integratations with Dealtrak, Codeweavers, and AutoConvert

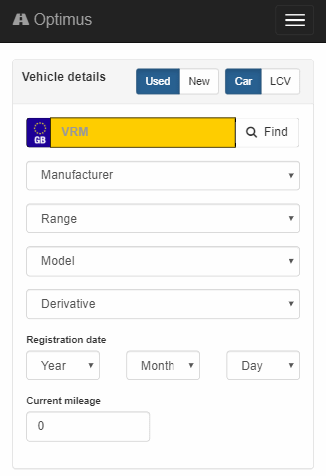

Optimus Point of Sale System

Optimus is a web-based Point of Sale system especially designed for car dealers.

The system allows you to build a finance proposal and then calculate an illustration for Hire Purchase, Personal Contract Purchase, and Lease Purchase finance products, for presentation to the customer. You can then use the system to collect the customer's details and submit the finance application to Jigsaw Finance and, once the application has been submitted, the system will keep you up to date with the status of the application during its processing by Jigsaw's underwriting team.

Other features include:

- Lookup vehicle by VRM or select by drop-down lists

- Print proposal to PDF

- Multiple secure user accounts for all your sales staff

- Branch segregation, should you have more than one site

Sign-up with Jigsaw Finance through our registration form here and get set-up with Optimus today.

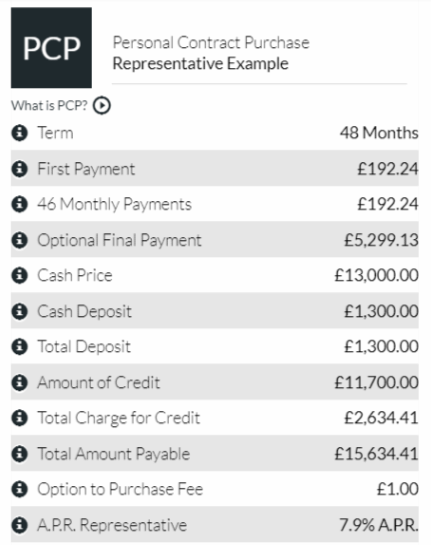

Finance Calculator Plugins

Finance Calculator Plugins are designed for integration into the vehicle pages on a dealer’s website.

The plugins allow your site visitors to calculate finance options against the vehicle price and then complete a finance application for submission to Jigsaw Finance. You will be able to track the progress of the application in an online portal during its processing by Jigsaw's underwriting team.

Other features include:

- Customers can optimise their illustration by Monthly Payment or Deposit

- Customers can email or print their illustration

- Finance explained video guides can also be embedded

Sign-up with Jigsaw Finance and arrange for finance calculator plugins to be integrated into your website today.

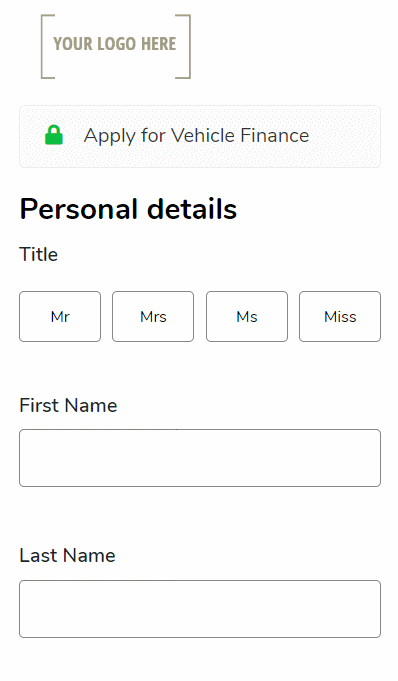

White-Labelled Application Forms

White-Labelled Finance Application forms are landing pages that are hosted by Jigsaw Finance Limited, but styled to complement your brand. They can be used as part of the customer journey on your website or even as part of an email marketing campaign that you run.

Developing finance application forms can be a costly process, but our white-labelled application forms can be integrated into your website with just a simple link.

For a more integrative feel, our application form is also available as an iframe.

Sign-up with Jigsaw Finance through our registration form here and liaise with our tech team to help you integrate our white-labelled finance application form landing page into your customer journey.

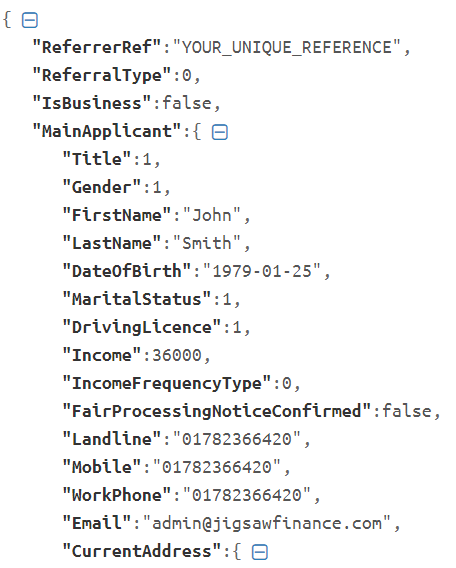

Application Programming Interface (API)

Jigsaw Finance’s APIs allow developers to integrate their software systems directly with ours.

This method of working with Jigsaw Finance is ideal for Introducers that have built their own CRM system for managing vehicle finance applications and want to use their system to send finance applications directly to Jigsaw Finance.

Sign-up with Jigsaw Finance and liaise with our tech team to help you integrate with our API.

Proprietary CRM Integrations

Dealtrak, Codeweavers and AutoConvert have integrated their CRM/DMS system with Jigsaw Finance, so once you are registered with Jigsaw Finance, you will be able to send your vehicle finance applications directly to us from there.

Sign-up with Jigsaw Finance through our registration form here and then ask your CRM representative to enable the facility.

Close Brothers Ltd

If you use the Showroom system from Close Brothers Ltd, then you can ensure that vehicle finance applications that are not approved by Close are referred to Jigsaw Finance, should your customer tick the 'Broker Referral Service' box during the application process.